Insurance Management System

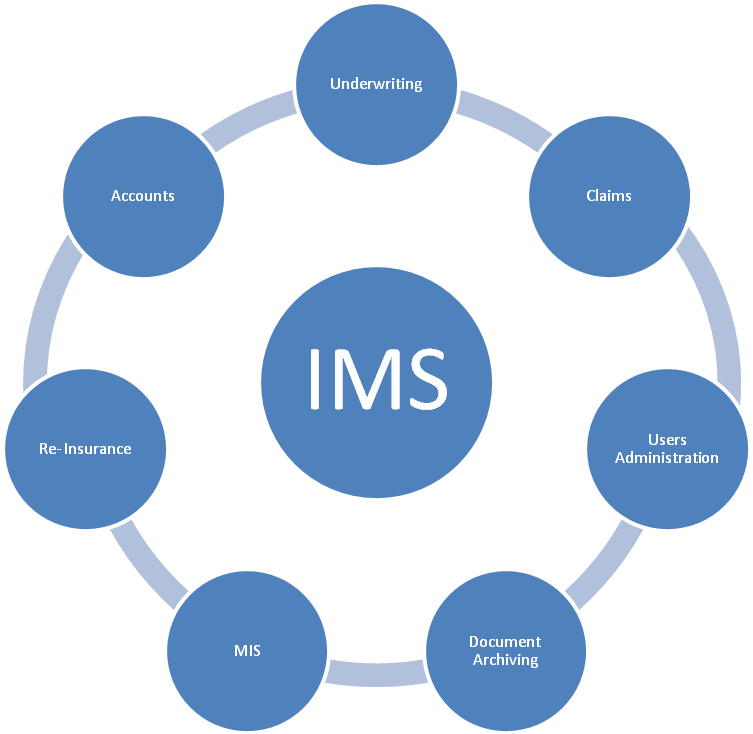

Insurance Management System (IMS) is comprehensive, reliable, performance-based, state of the art Insurance/Takaful system designed to accomplish workflows for your daily operations. All components of Insurance Management System are integrated into a single application. Its Dynamic Tree Structure for System Management allows Administrators/Owners to add their custom made modules with IMS. The system effectively cater all the requirements of insurance service providers. IMS core functionality includes:

- Underwriting

- Claims

- Account (General & Subsidiary)

- Re-Insurance

- Management Information system (MIS)

- Application Management

Salient features of IMS includes the following:

Underwriting

Underwriting documents are generated to deliver the policies/cover notes/ endorsements/renewal notices and other relevant documents to clients. Keeping in view, high service level agreement with clients, system is capable to generate underwriting documents in bulk very swiftly and accurately.

Underwriting operations, functionalities and procedures of IMS have been designed to facilitate underwriting user for performance of multiple tasks such as creation, posting/un-posting, printing and searching of documents.

It provides single and Easy-to-Use Interface to handle all types of underwriting operations and on-Screen menu To Facilitate User With all Relevant Information of Selected Document. Due to splendid features of Insurance management software, it becomes the first choice of underwriters.

- Support Direct, Co. Insurance & Re-Insurance Inward Business.

- Policy, Cover Note, Open Policy, Quotation Management.

- Endorsement Management.

- Automated Endorsement Types For Cancellation & Reversals.

- Automatic Premium and Duties Calculation.

- Controlled Agency & Commission Rate.

- Integrated Receivable/Payable Module.

- Maker & Checker Control.

- Validation Checks at Various Input Levels.

- Document Archiving.

- Searching By variety of criteria.

- Restricted Access To User On Their Assigned Branch, Policy Nature, Class of Business And Nature Of Transaction.

- Extensive logging.

- Underwriting Reports.

- Expiry Registers.

- System Generated Renewal Notices.

- SMS Alerts On Renewal.

- Email Alerts On Renewal.

- Powerful reporting engine with variety of filters and flexibility to add custom reports. Supports export data in various file formats like CSV, XML, HTML etc.

- Data Import utility to import thousands of policies at once from Excel files.

Claims

Claims constitute major element of cost incurred by an insurance company. Effective claim management is vital not only for survival and profitability but also for sustainable gaining competitive advantage over competitors. IMS claim module facilitates management in every aspect of claim operations and provides variety of reports for accurate and timely decision making.

- Controlled procedures for registration of claims to mitigate the risk of invalid claim intimations.

- A complete list of policies associated with the claims, as well as previous claims history, is immediately available to claims professionals to review and validate the claim.

- IMS provides comprehensive model of Claims operation which can be fully integrated with web portal for online claim intimation by clients/branches and mobile apps to facilitate surveyors for uploading of images of damaged assets.

- It includes claim tracking module capable to provide every information of all claims, form a single screen, with time logs as per given parameters.

- Offers rich reporting options and provide all relevant information needed by claim manager to monitor Progress / Claim Ratios of All Entities Involved in the Business.

- Pre-Defined Templates for all outgoing communications.

Accounting Module

Accounts department has very crucial responsibilities of compliance with prevailing regulations, financial management, book keeping and preparation of financial statements. To perform these functions effectively, it requires accurate, reliable and timely information from all other departments of the organization.

IMS “Accounts” module provides with the relevant information necessary to perform these functions. This module facilitates processing of accounting transactions such as receipts, payments adjustments and reporting requirements.

- Six level chart of accounts.

- Flexible Voucher Type Setup.

- Automated Tax Calculations On Claim Payments via Batch Claim Payment Module.

- Taxes Management Module

- Automatically calculate commissions due for each policy written on the basis of receipt premium.

- Automated Calculation of UPR.

- Financial statement automation.

- Bank Reconciliation.

- Check Printing.

- Variety of Receivable/Payable and Financial reports.

Re-Insurance/Re-Takaful Module

IMS Reinsurance module provides a superior solution to improve operational effectiveness and efficiency by simply and rapidly automating all reinsurance calculations and processes. Some of its key features include:

- Full support for all types of reinsurance contracts – treaty and facultative, proportional and non-proportional.

- Extensive and comprehensive automated processes for premium and claims allocation and calculation.

- All activities maintained in one easy-to-use user interface.

- Support for late placements/adjustments and for mid-term changes in reinsurance contracts.

- All-inclusive financial accounting module for current accounts management of reinsurers.

- A variety of accounting documents and bordereaux.

MIS Reporting

Management Information system (MIS) section offers insight into your data so you can be proactive and stay on top of the game.

- MIS module comprises object oriented reports mostly required by the management for decision making. Mainly includes progress, performance and top producer reports.

- Each progress report (based on Client, Agent or Branch) gives comparative information for last five years.

- It helps preparing budgets by showing actual figures and budgeted targets for the given parameters.

- Top producers report has multiple options of selecting top numbers, report bases such as premium, claim, outstanding or collection for the given parameters.

Application Management

The Application Management module facilitate Administrators to manage system security, Users and Their System Wide access. IMS security module has following distinctive features:

- Authentication must confirm three layers user security e-g status, number of bad attempts, Password expiry date.

- User access defined by allocated role suitable to assigned duties of each user.

- User access to IMS can be further managed by activation of authorized branches, class, transaction type, policy type, policy nature and printing option.

- Security module has user log and statistical report showing details of user access and transaction log with document count for monitoring/ user’s activities review.